Getting Started with Cryptocurrency: The Ultimate Beginner’s Handbook for 2024

Cryptocurrency has revolutionized the financial world, offering new avenues for investment and transactions. As a beginner, diving into the world of cryptocurrency can be daunting, but this comprehensive guide will provide you with the essential knowledge and tools to get started confidently.

Introduction to Cryptocurrency

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. The most well-known cryptocurrency is Bitcoin, but there are thousands of other cryptocurrencies available, each with its unique features and uses.

Brief History and Evolution of Cryptocurrency

The concept of cryptocurrency dates back to the late 20th century, but it wasn’t until 2009 that Bitcoin, the first decentralized cryptocurrency, was created by an anonymous entity known as Satoshi Nakamoto. Since then, the cryptocurrency landscape has evolved significantly, with the introduction of various altcoins (alternative cryptocurrencies) and the development of new blockchain technologies. Today, cryptocurrencies are used for a wide range of applications, from online transactions to investment opportunities.

Importance and Advantages of Cryptocurrency in Today’s World

Cryptocurrencies offer several advantages over traditional financial systems. They provide a decentralized and secure way to conduct transactions, reduce the need for intermediaries, and offer greater privacy and anonymity. Additionally, cryptocurrencies have the potential to provide financial services to unbanked populations and foster innovation in various industries through the use of blockchain technology.

Understanding Blockchain Technology

What is Blockchain?

Blockchain is the underlying technology behind most cryptocurrencies. It is a distributed ledger that records all transactions across a network of computers. Each block in the blockchain contains a list of transactions, and these blocks are linked together in a chain, creating a secure and immutable record of all transactions.

How Does Blockchain Work?

Blockchain works by using cryptographic techniques to secure and verify transactions. When a transaction is made, it is broadcast to the network and added to a pool of unconfirmed transactions. These transactions are then grouped into a block, which is added to the blockchain after being verified by network participants (known as miners). This process ensures the integrity and security of the blockchain, making it nearly impossible to alter past transactions.

Why is Blockchain Important for Cryptocurrencies?

Blockchain technology is crucial for cryptocurrencies as it provides a secure and transparent way to record and verify transactions. It eliminates the need for a central authority, reduces the risk of fraud, and ensures the integrity of the transaction history. Blockchain’s decentralized nature also enhances privacy and security, making it an ideal solution for digital currencies.

Getting Your First Cryptocurrency

Choosing a Cryptocurrency Exchange

To buy your first cryptocurrency, you’ll need to choose a reputable cryptocurrency exchange. Exchanges are platforms where you can buy, sell, and trade cryptocurrencies. Some popular exchanges include Coinbase, Binance, and Kraken. When choosing an exchange, consider factors such as security, fees, user interface, and the range of cryptocurrencies available.

Creating an Account and Verifying Your Identity

Once you’ve chosen an exchange, you’ll need to create an account and verify your identity. This process typically involves providing personal information and submitting identification documents to comply with regulatory requirements. Verification helps ensure the security of the exchange and prevents fraudulent activities.

Securing Your Cryptocurrency Wallet

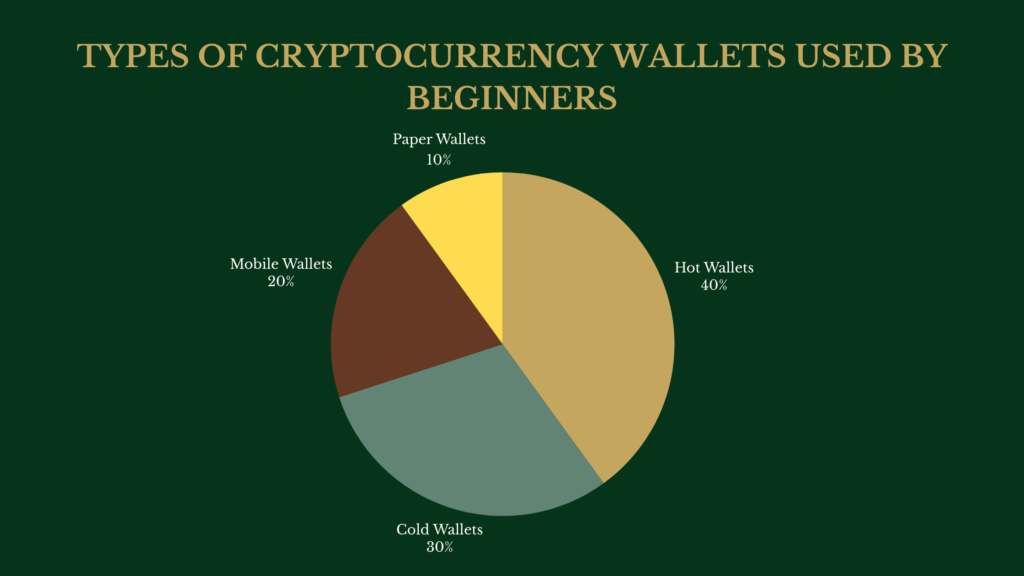

After purchasing cryptocurrency, you’ll need a secure place to store it. Cryptocurrency wallets come in various forms, including hot wallets (online) and cold wallets (offline). Hot wallets are convenient for frequent transactions, while cold wallets offer enhanced security for long-term storage. It’s essential to choose a wallet that suits your needs and follow best practices for securing your private keys.

Essential Cryptocurrency Concepts

Public and Private Keys

Public and private keys are fundamental concepts in cryptocurrency. A public key is like an address that you can share with others to receive cryptocurrency. A private key, on the other hand, is a secret code that allows you to access and manage your cryptocurrency. It’s crucial to keep your private key secure, as anyone with access to it can control your funds.

Wallet Types: Hot Wallets vs. Cold Wallets

Hot wallets are connected to the internet and are convenient for everyday transactions. However, they are more vulnerable to hacking. Cold wallets, such as hardware wallets and paper wallets, are offline and provide a higher level of security. They are ideal for storing large amounts of cryptocurrency that you don’t need to access frequently.

How to Buy and Sell Cryptocurrencies

Buying and selling cryptocurrencies involves placing orders on an exchange. You can place a market order to buy or sell at the current market price, or a limit order to buy or sell at a specific price. It’s essential to understand the different types of orders and the fees associated with trading to make informed decisions.

Popular Cryptocurrencies to Know

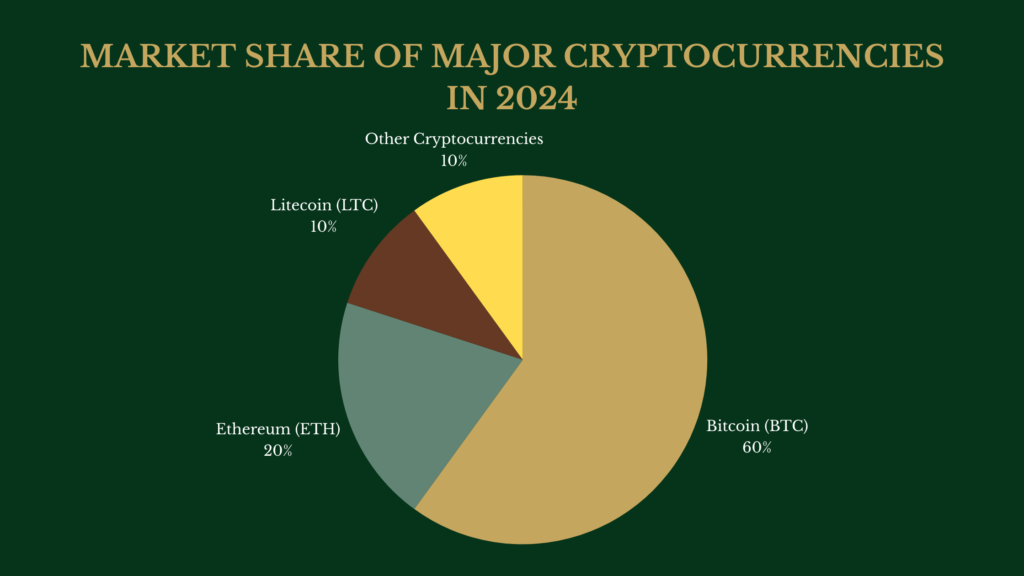

Overview of Major Cryptocurrencies (e.g., Bitcoin, Ethereum, Litecoin)

- Bitcoin (BTC): The first and most well-known cryptocurrency, Bitcoin is often referred to as digital gold. It is used primarily as a store of value and a medium of exchange.

- Ethereum (ETH): Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (dApps). Its native currency, Ether, is used to power these applications.

- Litecoin (LTC): Created as a “lighter” version of Bitcoin, Litecoin offers faster transaction times and lower fees. It is often used for smaller transactions and everyday purchases.

What Makes Each Cryptocurrency Unique?

- Bitcoin: Bitcoin’s uniqueness lies in its status as the first decentralized cryptocurrency and its widespread adoption and recognition.

- Ethereum: Ethereum’s ability to support smart contracts and dApps sets it apart from other cryptocurrencies, enabling a wide range of applications beyond simple transactions.

- Litecoin: Litecoin’s faster transaction times and lower fees make it an attractive option for everyday use and microtransactions.

Potential Use Cases and Future Outlook

Cryptocurrencies have a wide range of potential use cases, from remittances and micropayments to decentralized finance (DeFi) and non-fungible tokens (NFTs). As blockchain technology continues to evolve, we can expect new and innovative applications to emerge, further driving the adoption and value of cryptocurrencies.

Storing and Securing Your Cryptocurrency

Best Practices for Storing Your Cryptocurrencies Securely

- Use a Cold Wallet: For long-term storage, use a hardware wallet or paper wallet to keep your cryptocurrency offline and secure.

- Enable Two-Factor Authentication (2FA): Protect your exchange and wallet accounts with 2FA to add an extra layer of security.

- Regularly Update Your Software: Ensure your wallet software and devices are up to date to protect against vulnerabilities.

Understanding the Risks of Hacking and Theft

Cryptocurrency exchanges and wallets are attractive targets for hackers. It’s crucial to be aware of the risks and take necessary precautions to protect your assets. Use strong, unique passwords for your accounts and be cautious of phishing scams and other malicious activities.

Backup Strategies for Your Wallet and Private Keys

Regularly back up your wallet and private keys to protect against data loss. Store backups in multiple secure locations, such as encrypted USB drives or paper copies stored in a safe. Ensure your backups are updated whenever you make significant changes to your wallet.

Investing and Trading Basics

Introduction to Cryptocurrency Trading

Cryptocurrency trading involves buying and selling digital assets to profit from price fluctuations. There are various trading strategies, including day trading, swing trading, and long-term investing. It’s essential to understand the market dynamics and develop a trading plan that suits your risk tolerance and goals.

Fundamental vs. Technical Analysis

- Fundamental Analysis: This approach evaluates the intrinsic value of a cryptocurrency based on factors such as its technology, team, market demand, and overall potential.

- Technical Analysis: This method uses historical price data, charts, and indicators to predict future price movements. Traders often use technical analysis to identify trends and make informed trading decisions.

Tips for Managing Risk and Maximizing Returns

- Diversify Your Portfolio: Spread your investments across different cryptocurrencies to reduce risk.

- Set Stop-Loss Orders: Protect your investments by setting stop-loss orders to limit potential losses.

- Stay Informed: Keep up with market news and developments to make informed trading decisions.

Keeping Up with Cryptocurrency Trends

Resources for Staying Informed (e.g., Crypto News Websites, Social Media Channels)

- Crypto News Websites: Websites like CoinDesk, CoinTelegraph, and CryptoSlate provide up-to-date news and analysis on the cryptocurrency market.

- Social Media Channels: Follow influential figures and communities on platforms like Twitter, Reddit, and Telegram for real-time updates and insights.

Understanding Market Trends and Fluctuations

Cryptocurrency markets are known for their volatility. Understanding market trends and fluctuations can help you make informed investment decisions. Look for patterns, monitor trading volumes, and stay informed about factors that can impact prices, such as regulatory changes and technological advancements.

Potential Future Developments in the Cryptocurrency Space

The cryptocurrency space is constantly evolving, with new technologies and innovations emerging regularly. Some potential future developments include the widespread adoption of DeFi, the integration of blockchain in various industries, and the development of more scalable and energy-efficient blockchain solutions.

Risks and Considerations

Regulatory Challenges and Legal Considerations

Cryptocurrencies operate in a rapidly changing regulatory environment. It’s essential to stay informed about the legal status of cryptocurrencies in your jurisdiction and comply with relevant regulations to avoid potential legal issues.

Tax Implications of Cryptocurrency Transactions

Cryptocurrency transactions can have tax implications, depending on your country’s laws. Keep accurate records of your transactions and consult a tax professional to ensure compliance with tax regulations.

Common Pitfalls for Beginners and How to Avoid Them

- Lack of Research: Always do thorough research before investing in any cryptocurrency.

- Emotional Trading: Avoid making impulsive decisions based on market hype or fear.

- Security Negligence: Take necessary precautions to secure your assets and avoid common security risks.

Conclusion

Recap of Key Points Covered in the Handbook

This handbook has provided an in-depth overview of the essential aspects of getting started with cryptocurrency, including understanding blockchain technology, choosing and securing your first cryptocurrency, and navigating the world of trading and investing.

Final Thoughts on Getting Started with Cryptocurrency

Entering the world of cryptocurrency can be both exciting and challenging. By educating yourself and following best practices, you can navigate this new financial landscape with confidence and make informed decisions.

Encouragement for Continued Learning and Exploration in the Cryptocurrency World

Cryptocurrency and blockchain technology are constantly evolving. Stay curious, keep learning, and explore the endless possibilities this innovative field has to offer

FAQs

How do I buy my first cryptocurrency?

To buy your first cryptocurrency, you'll need to follow these steps:

- Choose a Cryptocurrency Exchange: Select a reputable exchange like Coinbase, Binance, or Kraken.

- Create an Account: Sign up and verify your identity on the chosen exchange.

- Deposit Funds: Deposit your local currency into your exchange account via bank transfer, credit card, or other accepted methods.

- Buy Cryptocurrency: Use the deposited funds to purchase the cryptocurrency of your choice.

What is a digital wallet, and why do I need one?

A digital wallet is a software or hardware tool that stores your cryptocurrency. It allows you to send, receive, and manage your digital assets. You need a wallet to store your private keys securely, which are necessary to access your cryptocurrency. There are two main types of wallets: hot wallets (online) for convenience and cold wallets (offline) for enhanced security.

How can I keep my cryptocurrency secure?

To keep your cryptocurrency secure, follow these best practices:

- Use a Cold Wallet: Store the majority of your funds in a hardware wallet or paper wallet, which are not connected to the internet.

- Enable Two-Factor Authentication (2FA): Protect your exchange and wallet accounts with 2FA.

- Keep Private Keys Safe: Never share your private keys and store them in a secure location.

- Regularly Update Software: Ensure your wallet software and any other tools you use are up to date to protect against vulnerabilities.

What are the risks associated with investing in cryptocurrency?

Investing in cryptocurrency carries several risks, including:

- Volatility: Cryptocurrency prices can be highly volatile, leading to significant gains or losses.

- Security Risks: Hacking, phishing attacks, and other security breaches can result in the loss of funds.

- Regulatory Uncertainty: Cryptocurrency regulations vary by country and can change, impacting the market.

- Lack of Consumer Protections: Unlike traditional financial systems, cryptocurrencies often lack regulatory oversight and consumer protections.

Where can I find reliable information and stay updated on cryptocurrency trends?

To stay informed and updated on cryptocurrency trends, consider the following resources:

- Crypto News Websites: Websites like CoinDesk, CoinTelegraph, and CryptoSlate provide up-to-date news and analysis.

- Social Media Channels: Follow influential figures and communities on platforms like Twitter, Reddit, and Telegram.

- Educational Resources: Online courses, webinars, and tutorials from reputable sources can help deepen your understanding of cryptocurrency.