Discover the Top 10 Credit Card Issuers in Delhi for 2024

Delhi, the bustling capital of India, is a hub of financial activity. With numerous credit card options available, choosing the right issuer can be overwhelming. This guide will delve into the top 10 credit card issuers in Delhi, highlighting their unique features, benefits, and services. Whether you’re looking for rewards, low-interest rates, or premium perks, this comprehensive review will help you make an informed decision.

Introduction

In the dynamic financial landscape of Delhi, credit cards have become an essential tool for managing personal finances. The variety of options available from different issuers makes it crucial to understand what each offers. This article explores the top 10 credit card issuers in Delhi, focusing on their standout features, customer service, and overall value.

Importance of Choosing the Right Credit Card Issuer

Selecting the right credit card issuer can significantly impact your financial health and convenience. The right card issuer offers benefits that align with your spending habits and financial goals, from rewards and cashback to travel perks and low-interest rates. Conversely, the wrong choice could result in high fees, subpar customer service, and limited benefits.

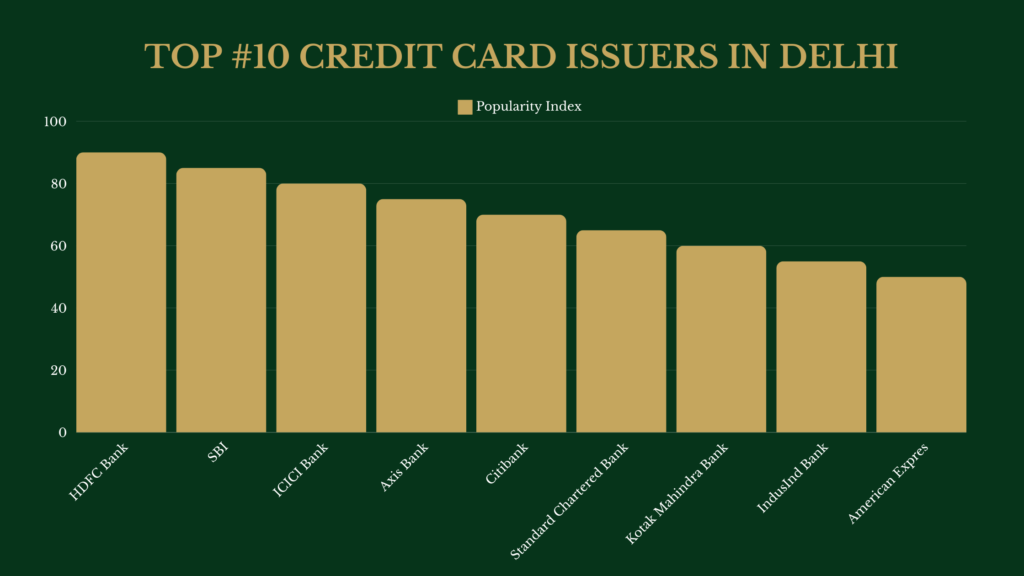

Overview of Popular Credit Card Issuers in Delhi

Delhi’s credit card market is competitive, with numerous issuers offering a wide range of products. This article will provide a detailed overview of the top 10 credit card issuers in Delhi, helping you understand their offerings and make an informed choice.

HDFC Bank

Overview of HDFC Bank’s Credit Card Offerings

HDFC Bank is one of India’s leading private sector banks, known for its extensive range of credit card products tailored to various customer needs. From premium cards offering exclusive privileges to basic cards designed for everyday use, HDFC Bank has a comprehensive portfolio.

Key Features, Benefits, and Rewards Programs

HDFC Bank’s credit cards are packed with features and benefits, including:

- Reward Points: HDFC’s reward program is one of the best in the market, offering points on every spend that can be redeemed for gifts, air miles, and discounts.

- Exclusive Privileges: Premium cardholders enjoy access to airport lounges, concierge services, and dining discounts.

- Fuel Surcharge Waiver: Many of their cards offer a waiver on fuel surcharges, making them ideal for frequent travelers.

- Interest Rates and Fees: Competitive interest rates and a transparent fee structure make HDFC cards an attractive option.

State Bank of India (SBI)

Overview of SBI’s Credit Card Offerings

State Bank of India (SBI) is the largest public sector bank in India and a major player in the credit card market. SBI Cards offers a wide variety of credit cards designed to cater to different customer segments.

Key Features, Benefits, and Eligibility Criteria

- Diverse Range of Cards: SBI offers cards for various needs, including travel, shopping, and dining.

- Reward Programs: SBI credit cards come with robust reward programs, offering points that can be redeemed for various benefits.

- Eligibility Criteria: SBI Cards are accessible, with eligibility criteria that cater to a broad audience, from students to high-income professionals.

- Customer Service: SBI’s extensive branch network ensures easy access to services and support across Delhi.

ICICI Bank

Overview of ICICI Bank’s Credit Card Offerings

ICICI Bank is another leading private sector bank in India, offering a diverse range of credit cards that cater to different lifestyles and financial needs.

Key Features, Benefits, and Types of Cards Available

- Wide Range of Cards: ICICI offers a variety of cards, including cashback cards, travel cards, and co-branded cards with leading brands.

- Reward Programs: ICICI’s reward programs are known for their flexibility and value, with points that can be redeemed for a wide range of products and services.

- Customer Service and Technology: ICICI Bank is recognized for its superior customer service and innovative digital banking solutions, enhancing the overall user experience.

Axis Bank

Overview of Axis Bank’s Credit Card Offerings

Axis Bank, one of India’s largest private sector banks, offers a robust lineup of credit cards tailored to meet various customer needs.

Key Features, Benefits, and Special Promotions

- Rewards and Cashback: Axis Bank credit cards come with attractive rewards and cashback offers, making them popular among shoppers.

- Special Promotions: Axis frequently runs promotions that provide additional benefits like extra reward points, discounts, and exclusive offers.

- Travel and Lifestyle Benefits: Many Axis Bank cards offer travel perks, including complimentary lounge access and discounts on hotel bookings.

Citibank

Overview of Citibank’s Credit Card Offerings

Citibank is known for its global presence and offers a range of credit cards that come with numerous benefits and rewards.

Key Features, Benefits, and Global Acceptance

- Global Acceptance: Citibank credit cards are widely accepted worldwide, making them ideal for frequent travelers.

- Reward Programs: Citibank offers robust reward programs with points that can be redeemed for travel, merchandise, and gift cards.

- Customer Service: Citibank is renowned for its customer service, ensuring a seamless experience for cardholders.

Standard Chartered Bank

Overview of Standard Chartered Bank’s Credit Card Offerings

Standard Chartered Bank offers premium credit cards that come with exclusive benefits and rewards programs.

Key Features, Benefits, and Rewards Programs

- Exclusive Benefits: Cardholders enjoy privileges like concierge services, airport lounge access, and dining discounts.

- Reward Programs: Standard Chartered’s reward programs offer high reward points on various spends, which can be redeemed for numerous benefits.

- Customer Service: The bank is known for its excellent customer service, providing personalized support to its cardholders.

Kotak Mahindra Bank

Overview of Kotak Mahindra Bank’s Credit Card Offerings

Kotak Mahindra Bank offers a variety of credit cards with features designed to enhance the banking experience.

Key Features, Benefits, and Customer Service

- Reward Points: Kotak cards offer competitive reward points on various categories like shopping, dining, and travel.

- Customer Service: Known for its customer-centric approach, Kotak Mahindra Bank provides excellent support and services.

- Innovative Features: The bank offers cards with innovative features such as customizable credit limits and flexible payment options.

IndusInd Bank

Overview of IndusInd Bank’s Credit Card Offerings

IndusInd Bank offers a range of credit cards that cater to different lifestyles and financial needs.

Key Features, Benefits, and Lifestyle Privileges

- Lifestyle Benefits: IndusInd Bank cards come with lifestyle privileges, including access to golf courses, concierge services, and dining discounts.

- Reward Programs: The bank’s reward programs offer points that can be redeemed for travel, merchandise, and more.

- Customer Service: IndusInd Bank is known for its excellent customer service, ensuring a positive experience for cardholders.

American Express

Overview of American Express’s Credit Card Offerings

American Express, known for its premium services, offers credit cards that provide a host of exclusive benefits.

Key Features, Benefits, and Exclusive Perks

- Premium Rewards: American Express cards offer premium rewards programs, including membership rewards points and travel perks.

- Exclusive Perks: Cardholders enjoy perks like airport lounge access, concierge services, and special event invitations.

- Customer Service: American Express is renowned for its exceptional customer service and support.

Conclusion

Delhi’s credit card market is diverse and competitive, offering numerous options for consumers. This guide has highlighted the top 10 credit card issuers in Delhi, each with its unique features and benefits. When choosing a credit card issuer, consider factors such as rewards programs, interest rates, customer service, and additional features to ensure you select a card that aligns with your financial goals and lifestyle.

FAQs

How can I choose the best credit card issuer in Delhi?

To choose the best credit card issuer, consider factors such as rewards programs, interest rates, fees, customer service, and additional features like mobile banking and fraud protection. Compare different issuers based on these parameters to find the one that best suits your needs.

What are the common types of rewards offered by credit card issuers?

Common types of rewards include cashback, travel miles, reward points, and discounts on purchases. Some issuers also offer exclusive benefits like airport lounge access, concierge services, and dining discounts.

How important is customer service in choosing a credit card issuer?

Customer service is crucial when choosing a credit card issuer as it ensures timely assistance and resolution of issues. Good customer service enhances the overall banking experience and provides peace of mind.

What additional features should I look for in a credit card?

Additional features to look for include mobile banking, online account management, fraud protection, and access to exclusive events and services. These features can greatly enhance your credit card experience.

Is it worth paying an annual fee for a credit card?

Paying an annual fee can be worth it if the card offers significant rewards and benefits that outweigh the cost. Premium cards with high annual fees often come with extensive perks such as travel insurance, airport lounge access, and higher reward rates.