Everything You Should Know About Startup Business Loans in India

Meta Description: Discover the essentials of startup business loans in India, including types, eligibility, application process, and success stories.

Introduction

In the dynamic and rapidly evolving landscape of Indian entrepreneurship, startup business loans play a pivotal role in nurturing innovation and economic growth. These financial instruments provide the necessary capital for aspiring entrepreneurs to transform their ideas into viable business ventures. This comprehensive guide delves into the nuances of startup business loans in India, offering valuable insights for those seeking to embark on their entrepreneurial journey.

What are Startup Business Loans?

Definition and Purpose of Startup Business Loans

Startup business loans are financial products specifically designed to support the establishment and growth of new businesses. These loans provide the capital required for various purposes, including product development, marketing, infrastructure, and operational expenses. By offering access to funds, startup business loans empower entrepreneurs to turn their innovative ideas into reality, fostering economic development and job creation.

Benefits of Acquiring Startup Loans for New Businesses

Acquiring startup loans offers numerous benefits to budding entrepreneurs. Firstly, these loans provide the much-needed financial support to cover initial costs and sustain operations during the early stages. Additionally, securing a startup loan can help build a business’s credit history, making it easier to access larger funds in the future. Moreover, with the right loan, entrepreneurs can maintain full ownership of their business without diluting equity through venture capital or other investment forms.

Types of Startup Business Loans

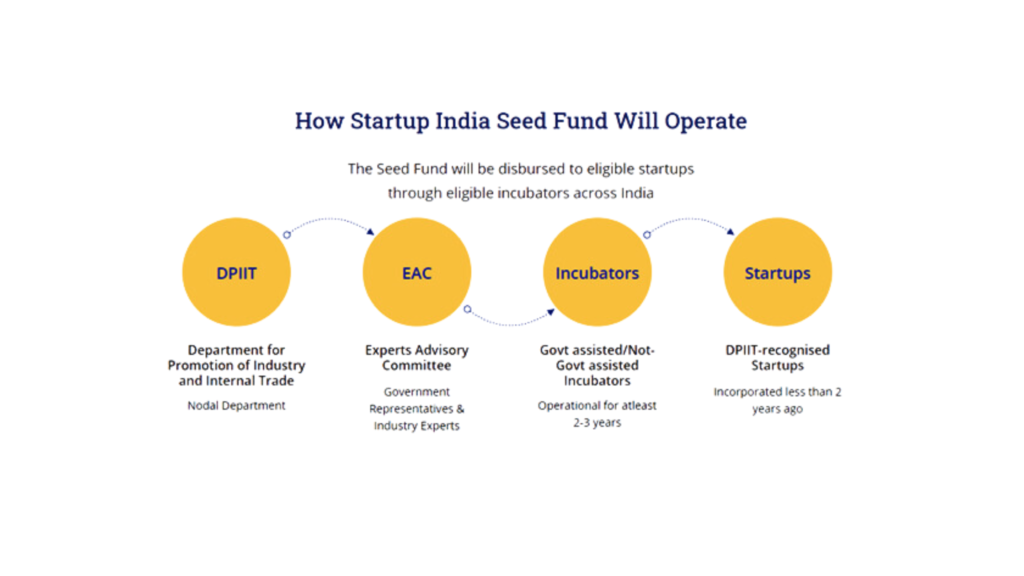

Government-Backed Schemes

India offers a variety of government-backed schemes to support startups, each tailored to different needs and sectors. Notable among these are:

Mudra Yojana: This scheme provides loans up to ₹10 lakh to non-corporate, non-farm small/micro enterprises. It includes three categories: Shishu (up to ₹50,000), Kishor (₹50,001 to ₹5 lakh), and Tarun (₹5 lakh to ₹10 lakh).

Stand-Up India: Targeted at women and SC/ST entrepreneurs, this scheme offers loans ranging from ₹10 lakh to ₹1 crore for greenfield enterprises in manufacturing, services, or trading sectors.

Private Financing Options and Venture Capital

Beyond government schemes, numerous private financing options are available. These include:

Angel Investors and Venture Capitalists: These investors provide capital in exchange for equity or convertible debt, often bringing valuable expertise and mentorship.

Banks and Non-Banking Financial Companies (NBFCs): Traditional financial institutions offer various loan products tailored for startups, often with competitive interest rates and flexible terms.

Crowdfunding: This innovative financing method involves raising small amounts of money from a large number of people, typically via online platforms.

Eligibility Criteria

Factors Considered by Lenders

Lenders evaluate several factors before approving startup business loans. Key considerations include:

Credit Score: A strong credit score indicates financial responsibility and increases the chances of loan approval.

Business Plan: A well-structured business plan showcasing market analysis, financial projections, and growth strategies is crucial.

Collateral: Some loans may require collateral, such as property or equipment, to secure the funding.

Business Experience: Previous entrepreneurial experience or industry expertise can positively influence the approval process.

Tips to Improve Eligibility for Startup Loans

To enhance your eligibility for a startup loan, consider the following tips:

Improve Your Credit Score: Regularly monitor and improve your credit score by paying bills on time and reducing outstanding debts.

Develop a Robust Business Plan: Invest time in creating a comprehensive business plan that clearly outlines your vision, strategy, and financial projections.

Explore Collateral Options: Assess available assets that can be used as collateral to secure your loan.

Application Process

Step-by-Step Guide to Applying for Startup Business Loans

Navigating the application process for startup loans can be streamlined by following these steps:

Research and Compare Lenders: Identify potential lenders and compare their loan products, interest rates, and terms.

Prepare Documentation: Gather necessary documents, including a detailed business plan, financial statements, personal and business credit reports, and proof of collateral (if required).

Submit Application: Complete the loan application form, ensuring all information is accurate and complete.

Follow Up: Maintain communication with the lender to address any queries and track the application’s progress.

Documentation Requirements and Common Pitfalls to Avoid

When applying for a startup loan, ensure you have the following documents:

Business Plan: A detailed plan outlining your business model, market analysis, and financial projections.

Financial Statements: Personal and business financial statements, including income tax returns, bank statements, and balance sheets.

Credit Reports: Personal and business credit reports to demonstrate creditworthiness.

Collateral Documentation: Proof of ownership and valuation of any assets offered as collateral.

Common Pitfalls to Avoid: Incomplete applications, inaccurate financial projections, and lack of a solid business plan are common mistakes that can hinder loan approval.

Interest Rates and Repayment Terms

Understanding the Financial Implications of Startup Loans

Interest rates and repayment terms significantly impact the cost of borrowing and the overall financial health of your startup. It’s essential to understand these aspects to make informed decisions.

Comparison of Interest Rates Offered by Different Lenders

Interest rates vary based on the type of loan, lender, and your creditworthiness. Government-backed loans typically offer lower interest rates compared to private financing options. For instance, Mudra Yojana loans have competitive rates, while venture capital funding might involve higher costs due to equity dilution.

Success Stories

Case Studies of Successful Startups Funded Through Business Loans

Examining success stories provides valuable insights into how startup loans can propel businesses to new heights. Consider the following examples:

Zoho Corporation: Initially funded through loans, Zoho has grown into a global leader in SaaS products, offering an extensive suite of business software.

OYO Rooms: This budget hotel chain leveraged startup loans to expand its operations, becoming one of the largest hospitality chains worldwide.

Lessons Learned and Strategies for Leveraging Startup Financing

Key lessons from successful startups include:

Strategic Utilization of Funds: Use loans strategically for activities that directly contribute to business growth, such as product development and marketing.

Maintaining Financial Discipline: Ensure timely repayments to build a positive credit history and maintain good relationships with lenders.

Challenges and Considerations

Potential Challenges in Securing and Managing Startup Loans

Securing and managing startup loans come with inherent challenges, such as:

Stringent Eligibility Criteria: Meeting lenders’ requirements can be difficult for new businesses without a proven track record.

Financial Risks: High interest rates and repayment obligations can strain a startup’s cash flow, potentially leading to financial distress.

Mitigation Strategies and Expert Advice

To mitigate these challenges, consider the following strategies:

Seek Expert Advice: Consult with financial advisors or mentors to navigate the loan application process and manage funds effectively.

Diversify Funding Sources: Explore multiple funding options, such as grants, angel investors, and crowdfunding, to reduce reliance on loans.

Conclusion

In conclusion, startup business loans in India are instrumental in fostering entrepreneurship and driving economic growth. By understanding the various loan options, eligibility criteria, and application processes, aspiring entrepreneurs can secure the necessary funding to launch and scale their ventures. Remember to leverage success stories, seek expert advice, and adopt strategic financial management practices to maximize the benefits of startup financing.

For those ready to take the next step in their entrepreneurial journey, explore further resources or consult with financial experts to identify the best startup loan options for your business. Subscribe to our updates for the latest information on business financing in India.

FAQs

How can I improve my eligibility for a startup loan?

Improving your credit score, developing a robust business plan, and preparing collateral are key steps to enhance your eligibility for a startup loan.

What government schemes support startups in India?

Notable government schemes include Mudra Yojana and Stand-Up India, both offering financial assistance tailored to different types of entrepreneurs and business needs.

What are the benefits of acquiring a startup loan?

Startup loans provide essential funding for initial costs, help build credit history, and allow entrepreneurs to maintain full ownership of their business.

How do interest rates and repayment terms affect startup loans?

Interest rates and repayment terms impact the overall cost of borrowing and cash flow management. It's crucial to compare different lenders and understand these financial implications before securing a loan.

Can you provide examples of successful startups funded through loans?

Zoho Corporation and OYO Rooms are notable examples of successful startups that leveraged business loans for their growth and expansion.